Lynnwood Housing Market | February 2026 with Price Point Breakdown

by Brandice Raybourn

Quick Take

This Lynnwood housing market update reflects January 2026 activity and shows a market that is selective, uneven, and highly dependent on price point. Some parts of the market are moving quickly and cleanly, while others are slow, patient, and far less forgiving than they were even a year ago. Buyers are cautious, sellers are adjusting expectations, and outcomes are driven by condition, pricing accuracy, and how well a home stands out in its range.

January reflects a very typical winter market in Lynnwood. Activity slowed across much of the resale landscape, with longer days on market showing just how deliberate buyers have become. At the same time, certain housing types and price ranges performed surprisingly well, especially new construction, townhomes, and a specific higher-end range that moved faster than anything else in the city and surrounding cities.

Citywide averages only tell part of the story here. When you break Lynnwood down by housing type and price point, the experience for buyers and sellers looks very different depending on where a home sits. That gap between fast-moving pockets and slower ones is exactly why a price-point breakdown matters in this market.

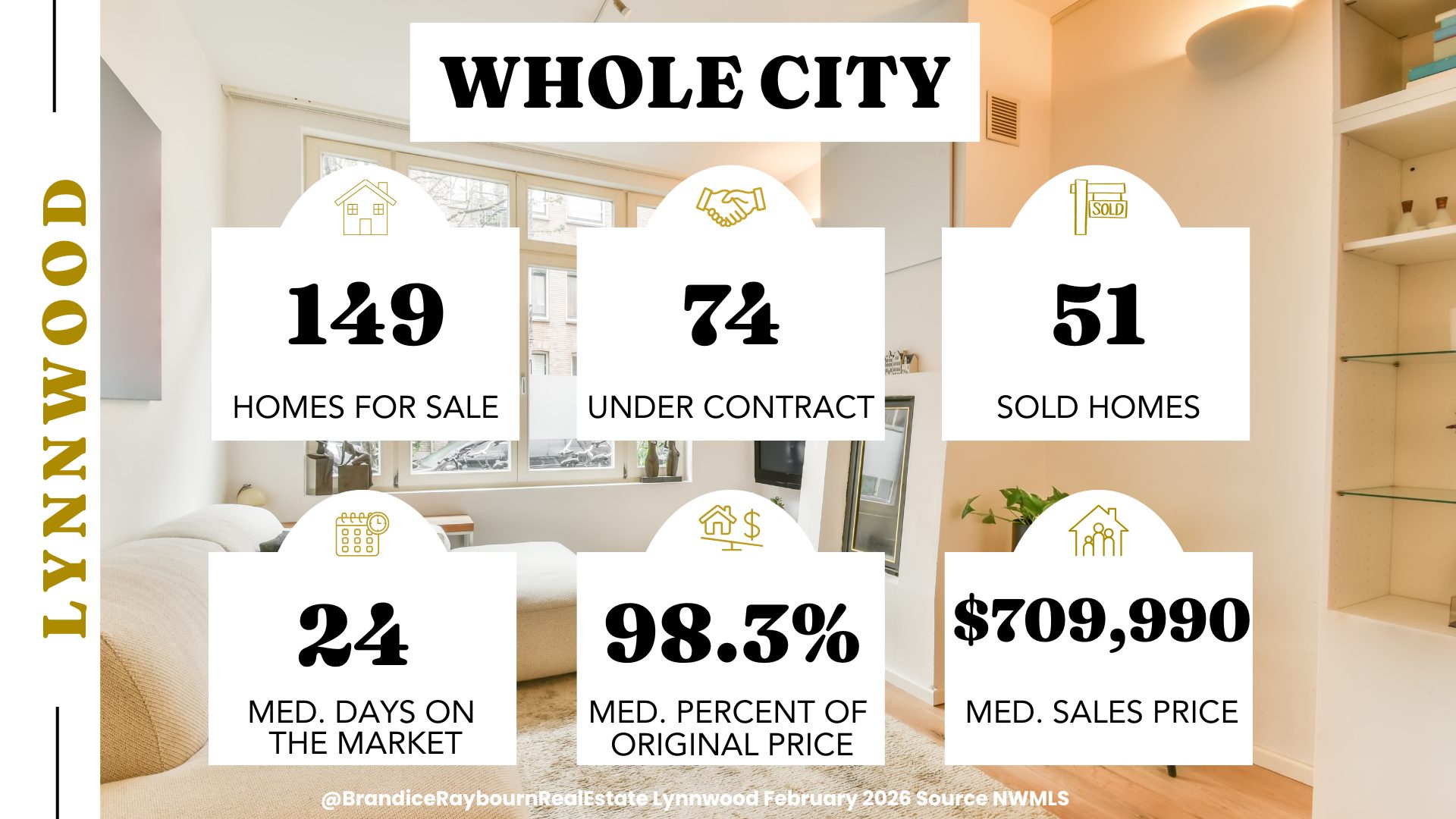

Whole City Snapshot

Across Lynnwood, the market is active but selective. Homes are moving, but they are not flying off the shelf unless they are priced right and present well. Buyers are paying close to asking price overall, but they are taking their time and comparing options carefully. Sellers who assume strong demand without strong presentation are feeling that hesitation quickly.

Source: NWMLS | Analysis by Brandice Raybourn

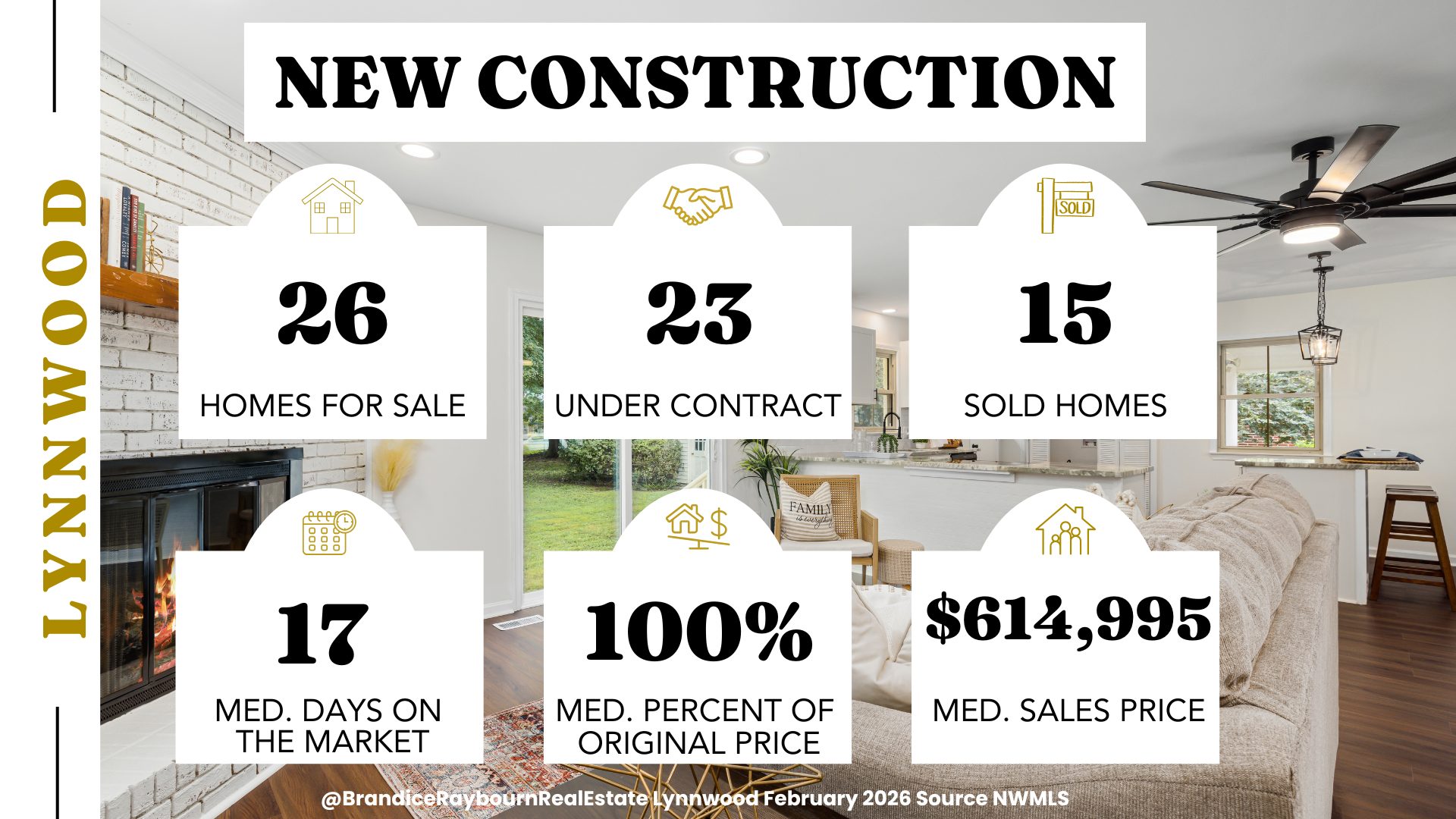

New Construction

New construction has one of the highest inventory levels in Lynnwood right now, which gives buyers more choice even though these homes are still going under contract quickly. Builders are getting 100 percent of list price, so instead of price adjustments, flexibility is showing up through incentives like closing cost credits, rate buydowns, or upgrades.

The homes you see on the MLS are only part of what is available. Builders often release homes in phases, so if you have a specific builder, lot, or layout in mind, looking early matters because the most desirable options move fast.

One important heads up for buyers is representation. Most builders in the PNW do pay for buyers to have an agent, but your agent must be with you on the first visit or set up the initial walkthrough. Walking in without representation can limit your ability to have an agent advocate for you.

Source: NWMLS | Analysis by Brandice Raybourn

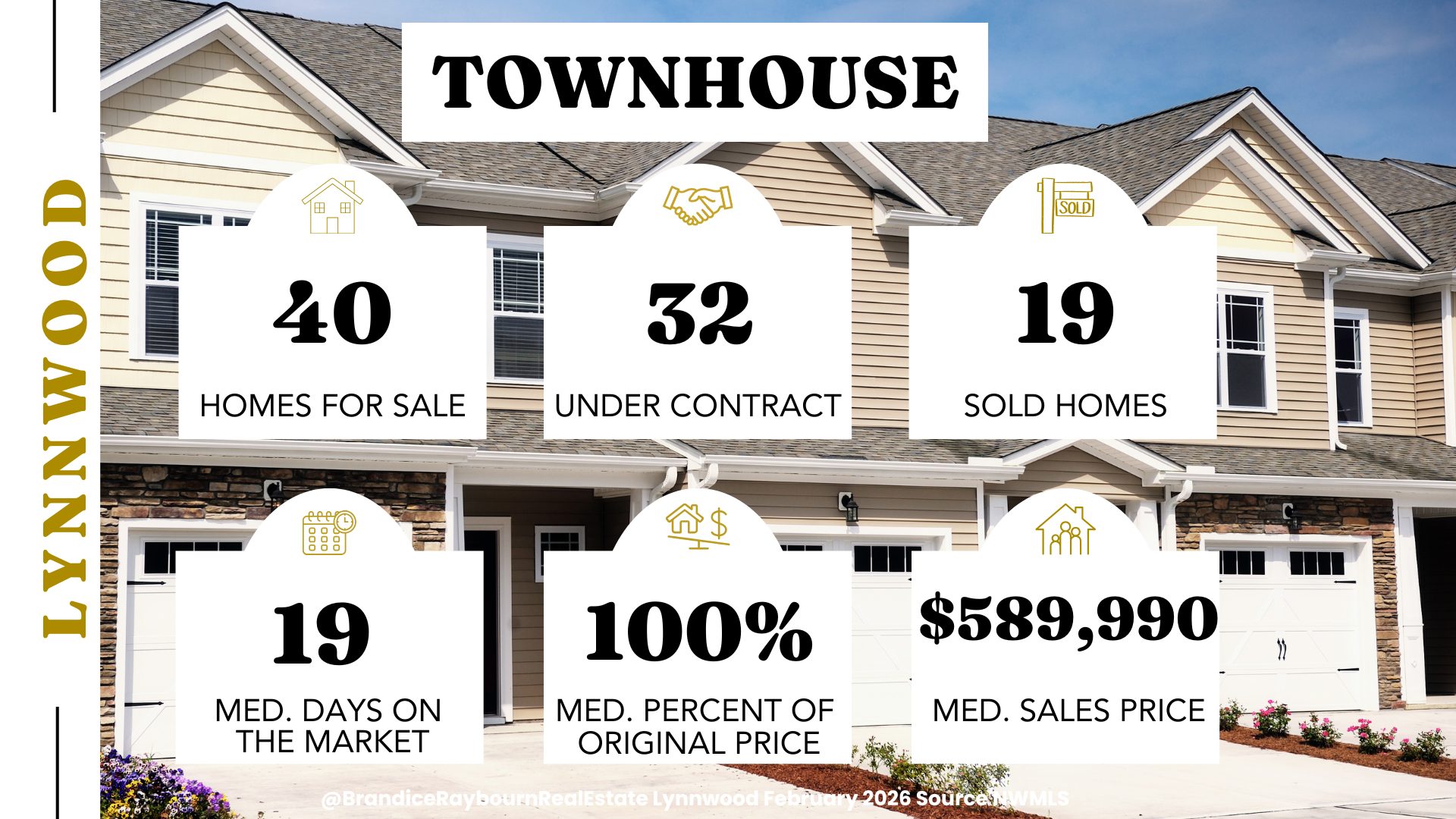

Townhomes

Townhomes are also looking very good for sellers.

They are moving quickly, contracts are coming together smoothly, and sellers are consistently landing at full price. Buyers in this category are practical and focused. They are often choosing townhomes intentionally for layout, maintenance, or price point rather than settling.

From a showing perspective, these homes feel competitive without being chaotic. Good townhomes do not sit.

Source: NWMLS | Analysis by Brandice Raybourn

Condos

Condo activity is slower and more uneven.

Buyers are cautious here. Showings are happening, but decisions take longer and pricing sensitivity is higher. Condos that are well run, well located, and well priced still sell, but this is not a category where sellers can rely on momentum alone.

Expect longer conversations and fewer impulse offers.

Source: NWMLS | Analysis by Brandice Raybourn

Residential Resale

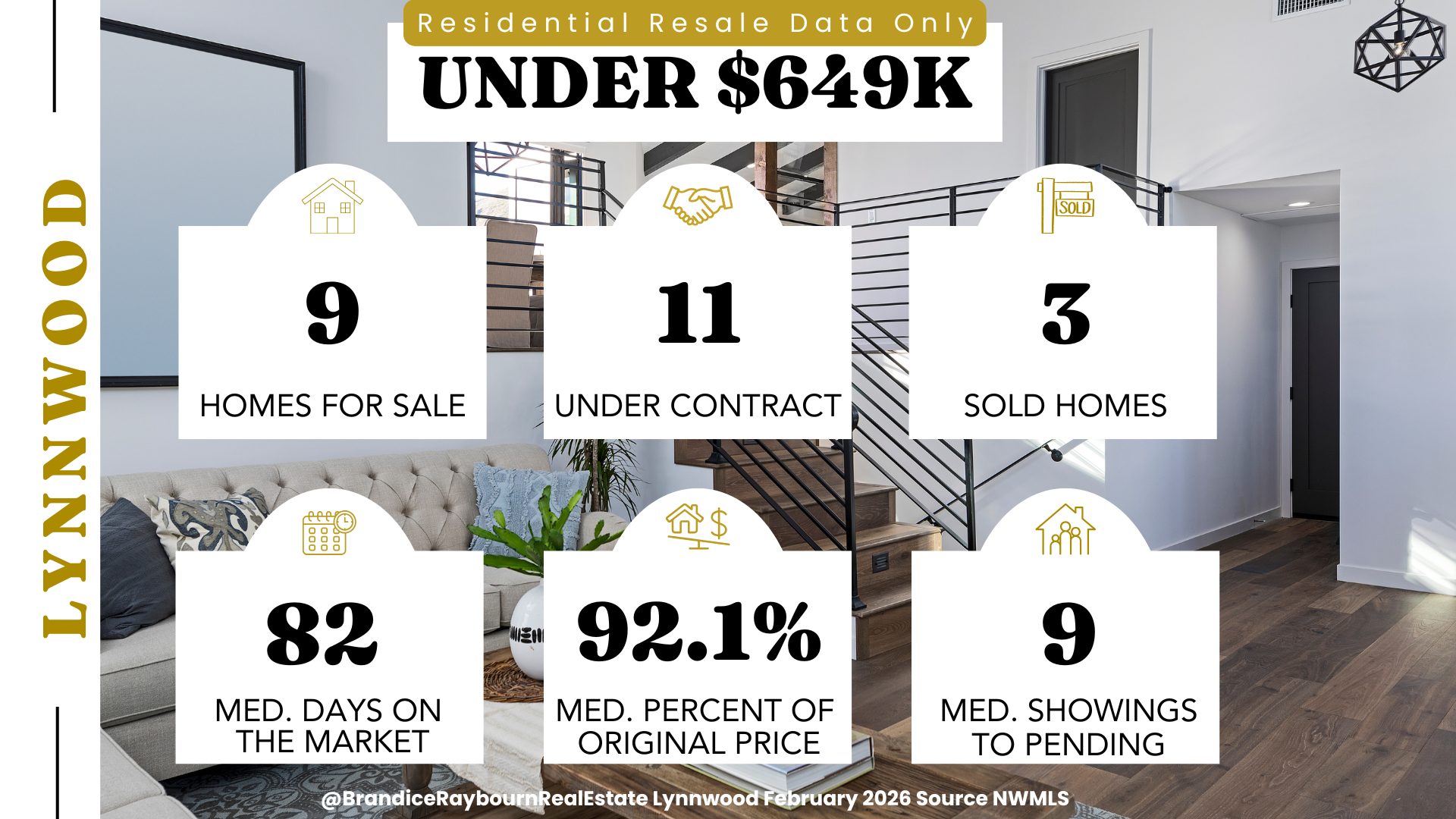

Under 649K

When you look at the actual inventory, much of what appears here is townhomes classified as residential in the MLS. True detached resale inventory is actually quite limited.

Only 3 homes sold in this range last month. Based on those sales, sellers saw around 9 showings before going under contract. Days on market look high at first glance, but that is because the homes that sold had been sitting for quite some time before finally finding the right buyer.

This is not a fast or hot range, but it is not dead either. Buyers are patient and value driven. Sellers who adjust expectations and pricing are the ones who eventually get traction.

Source: NWMLS | Analysis by Brandice Raybourn

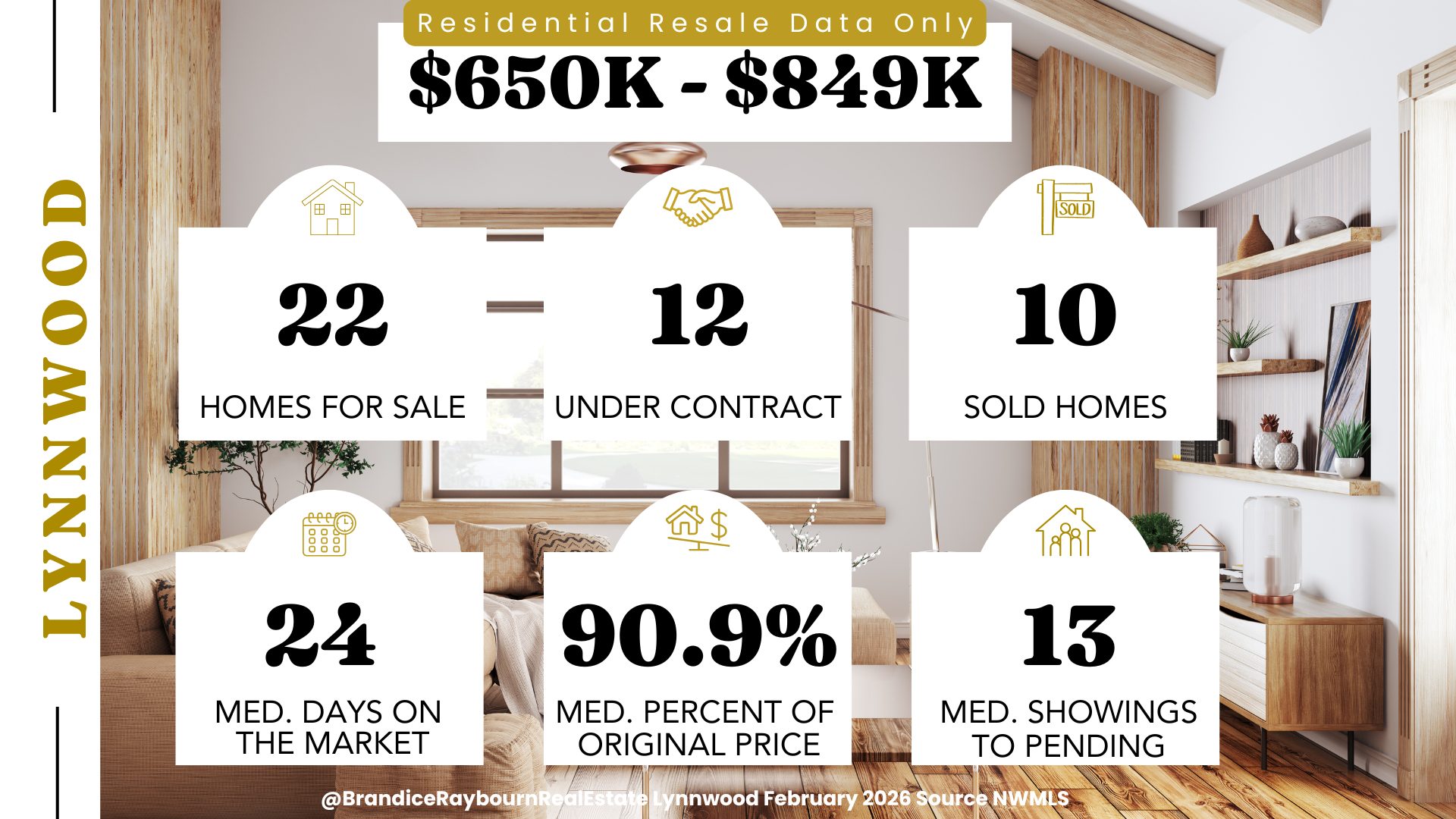

650K to 849K

This range feels balanced but cautious.

Buyers are active, but they are comparing heavily and not rushing. Showings happen, but offers come after reflection rather than excitement. Pricing matters a lot here. Homes that feel slightly overpriced stall quickly.

This is a range where sellers need to be realistic from day one.

Source: NWMLS | Analysis by Brandice Raybourn

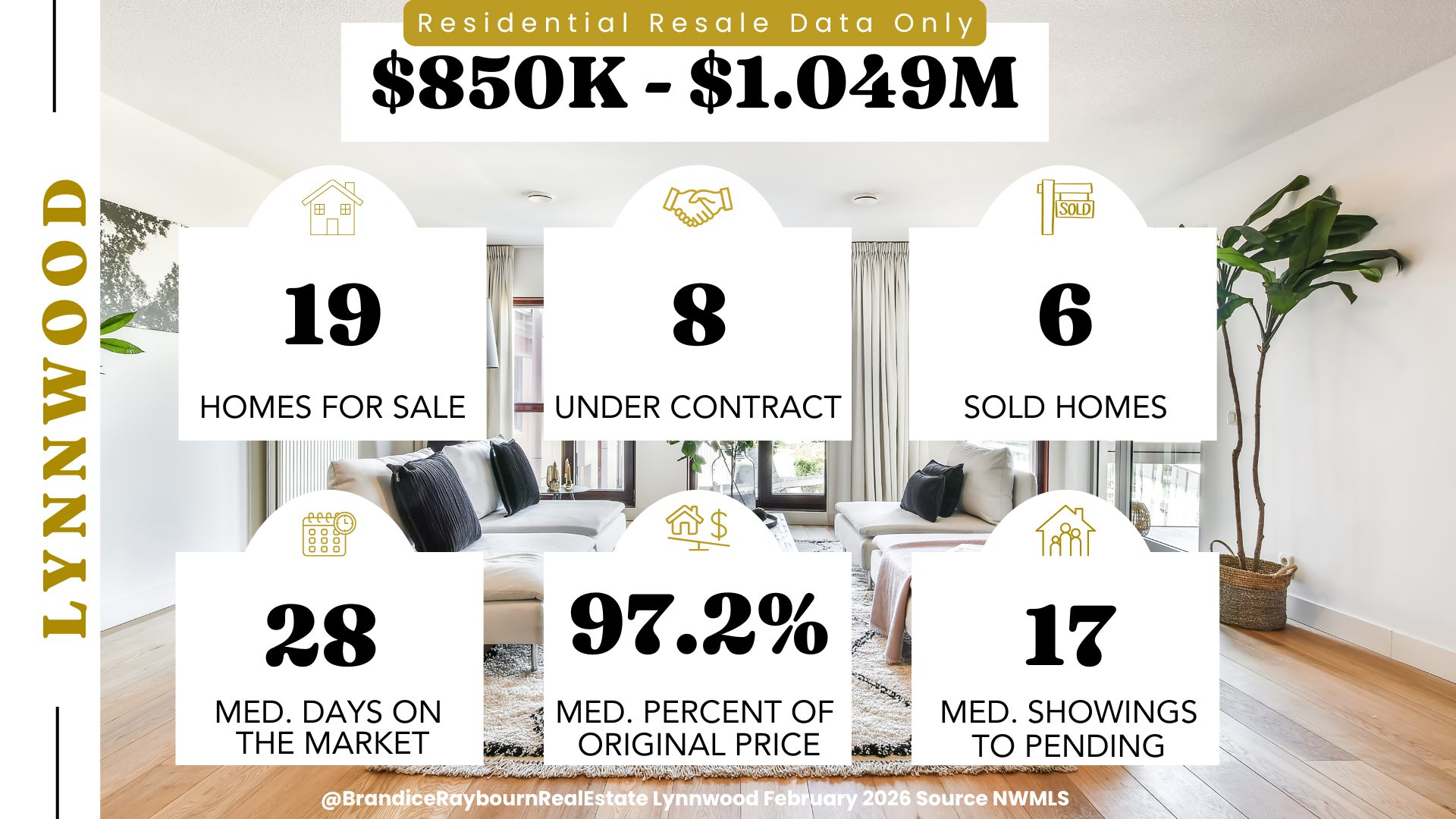

850K to 1.049M

This range is moving, but it rewards preparation.

Buyers here are serious and financially ready, but they still expect value. Homes that are clean, updated, and priced appropriately move at a reasonable pace. Homes that miss the mark tend to sit and usually need adjustments.

Sellers should expect to see around 17 showings before going under contract. There is a decent amount of inventory in this range, so sellers need to look closely at their competition

This range feels steady rather than emotional, with buyers making thoughtful decisions instead of rushed ones.

Source: NWMLS | Analysis by Brandice Raybourn

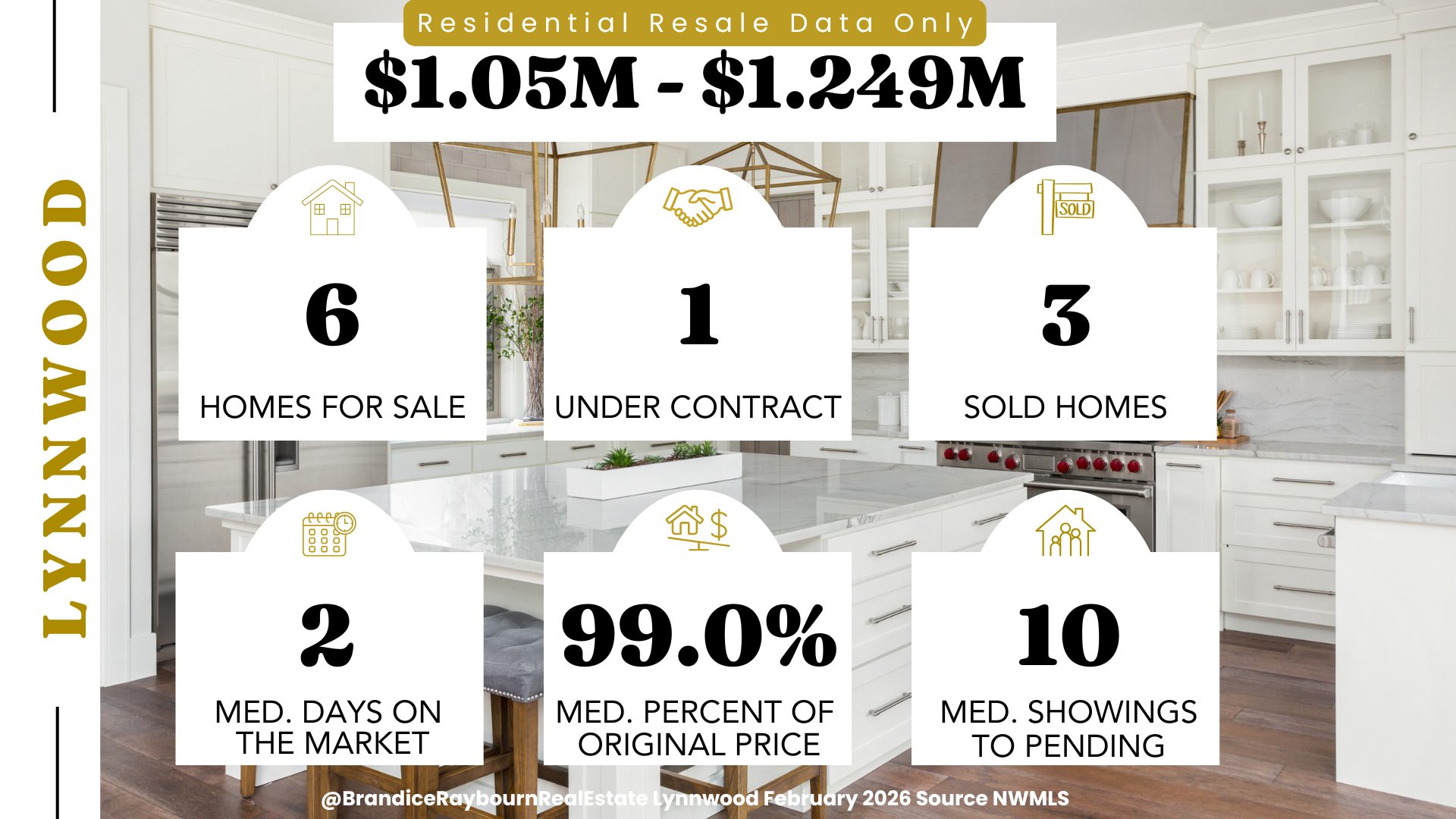

1.05M to 1.249M

This was the most surprising range in the entire report.

Based on the 3 homes that sold last month, homes went pending after about 10 showings and just 2 days on the market. Yes, 2 days.

This is the fastest moving price range across all of the city reports I track throughout Snohomish County and North King County.

If you are a seller in this range, expect a fast turnaround if your home is a standout. Buyers here know exactly what they want and move quickly when a property checks their boxes.

Condition and presentation in this range will pay off quickly.

Source: NWMLS | Analysis by Brandice Raybourn

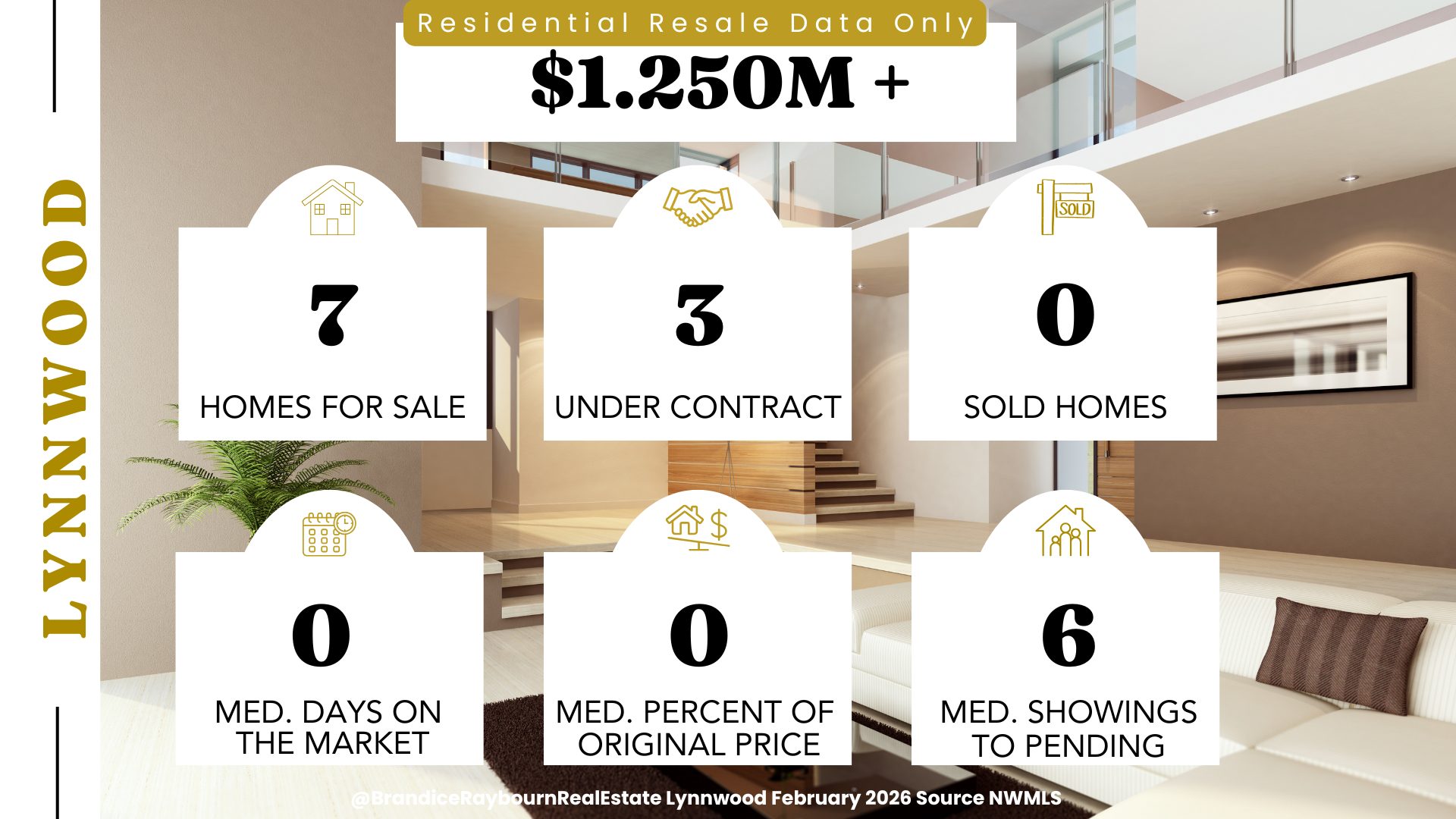

1.25M and Above

There were no closed sales in this range last month, which means there is no true pulse check from sold data.

That said, inventory is also very limited. Sellers who went under contract saw an average of 6 buyers walk through their homes before going pending.

Homes are sitting around a month on market, but without closed sales, the story is incomplete. My read is that buyers who can afford this range are often comparing Lynnwood to other areas first unless the home is an absolute stunner.

This is a niche range. When the right home appears, buyers engage. Otherwise, they wait.

Source: NWMLS | Analysis by Brandice Raybourn

Final Thoughts

Lynnwood right now is not about speed for everyone. It is about fit.

Some ranges are moving extremely fast when the home stands out. Others require patience, pricing discipline, and realistic expectations. Buyers are active, but they are thoughtful. Sellers who understand where their home truly fits are having much better experiences than those who rely on assumptions.

You do not need to time the market. You need to understand it.

Brandice Raybourn

Coldwell Banker Danforth

Everett Real Estate Broker

brandice@snohomesbybrandice.com

425-367-3881

If these Lynnwood market updates are useful, you can have them sent straight to your inbox here.

Get Monthly Market Updates

Curious about nearby city:

Snohomish Housing Market | February 2026

Everett Housing Market Update | February 2026

Bothell Housing Market Update – February 2026

Bellevue Housing Market Update | February 2026

Lake Stevens Housing Market Update | February 2026

Marysville Housing Market Update| February 2026