Bellevue Housing Market Update | February 2026

By: Brandice Raybourn, Licensed Real Estate Broker |

This Bellevue housing market update reflects January 2026 activity using NWMLS data. What stands out this month is not a sudden shift in direction, but a clear change in how the market feels to participate in.

Inventory is up, days on market are longer, and buyers are taking more time almost across the board. Homes are still selling, but the urgency that carried the market through late 2025 has softened. This is no longer a momentum-driven market. It is a selection-based one.

Across Bellevue, behavior now depends heavily on housing type and price point.

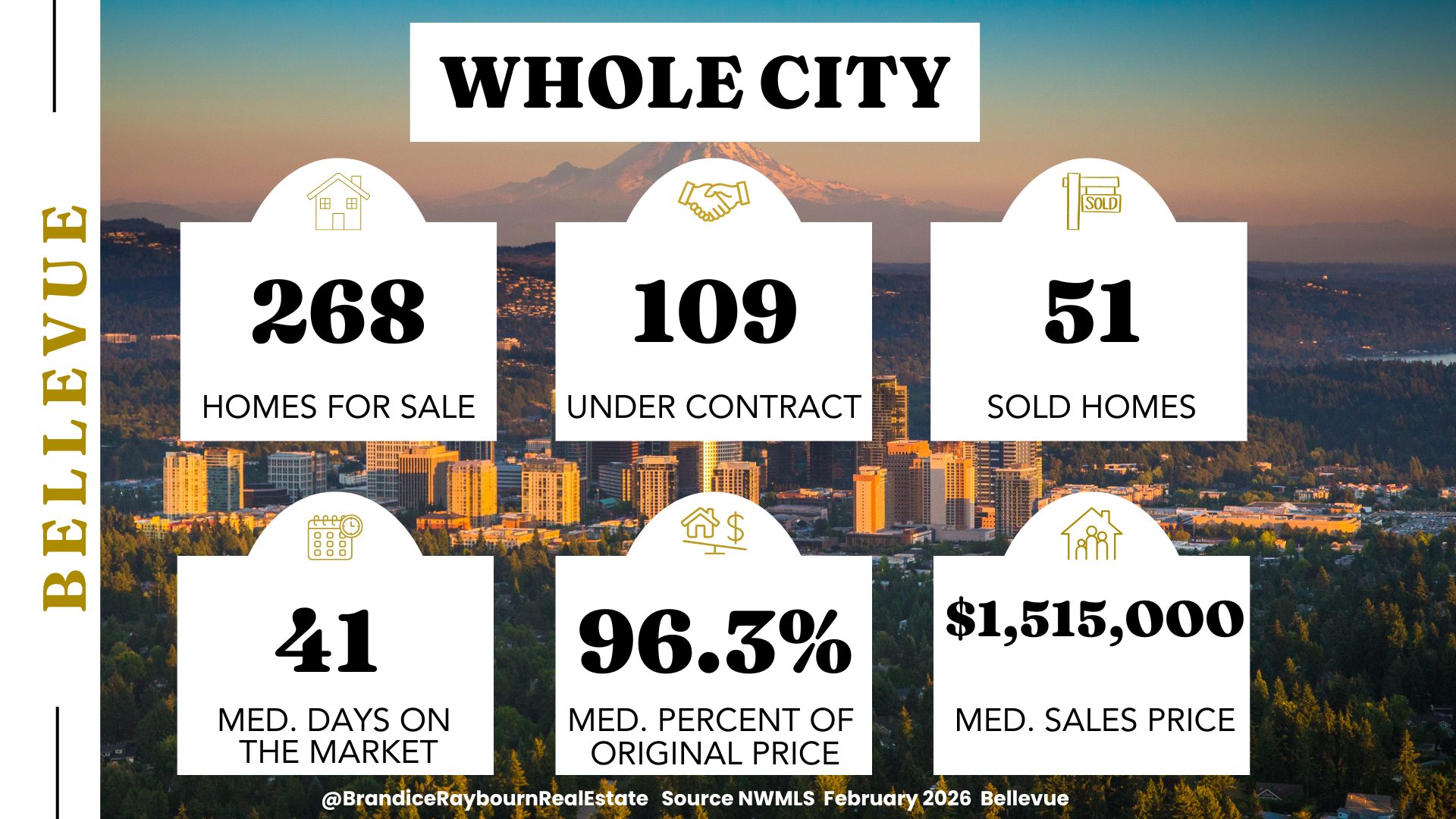

Whole city: more inventory, less urgency

Citywide inventory increased meaningfully, and median days on market stretched to over 40 days. That combination alone changes buyer behavior. Buyers feel less pressure to act quickly and more confidence walking away when something does not feel right.

This does not mean demand disappeared. It means buyers are exercising choice. Sellers can still sell, but only when pricing and condition align with what buyers now expect.

This is what a balanced market looks like when inventory starts to rebuild.

Source: NWMLS | Analysis by Brandice Raybourn

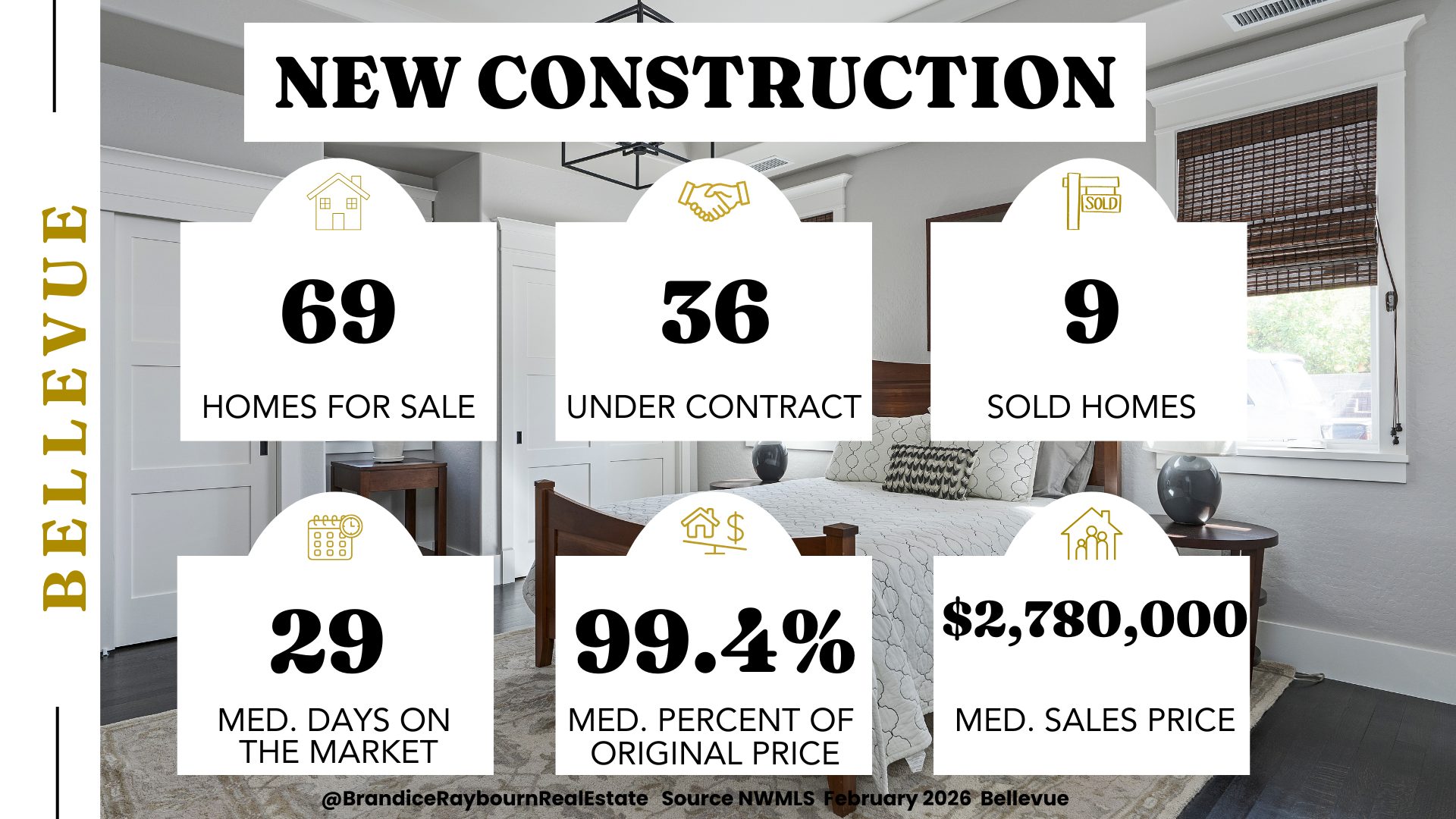

New construction: options without urgency

New construction inventory remains elevated relative to how many homes are going under contract. Buyers are comparing builders, locations, layouts, and incentives carefully.

Pricing has largely held, but incentives are doing more of the work. Homes that clearly stand out still move. Homes that feel interchangeable sit longer. This category reflects patience, not weakness.

Source: NWMLS | Analysis by Brandice Raybourn

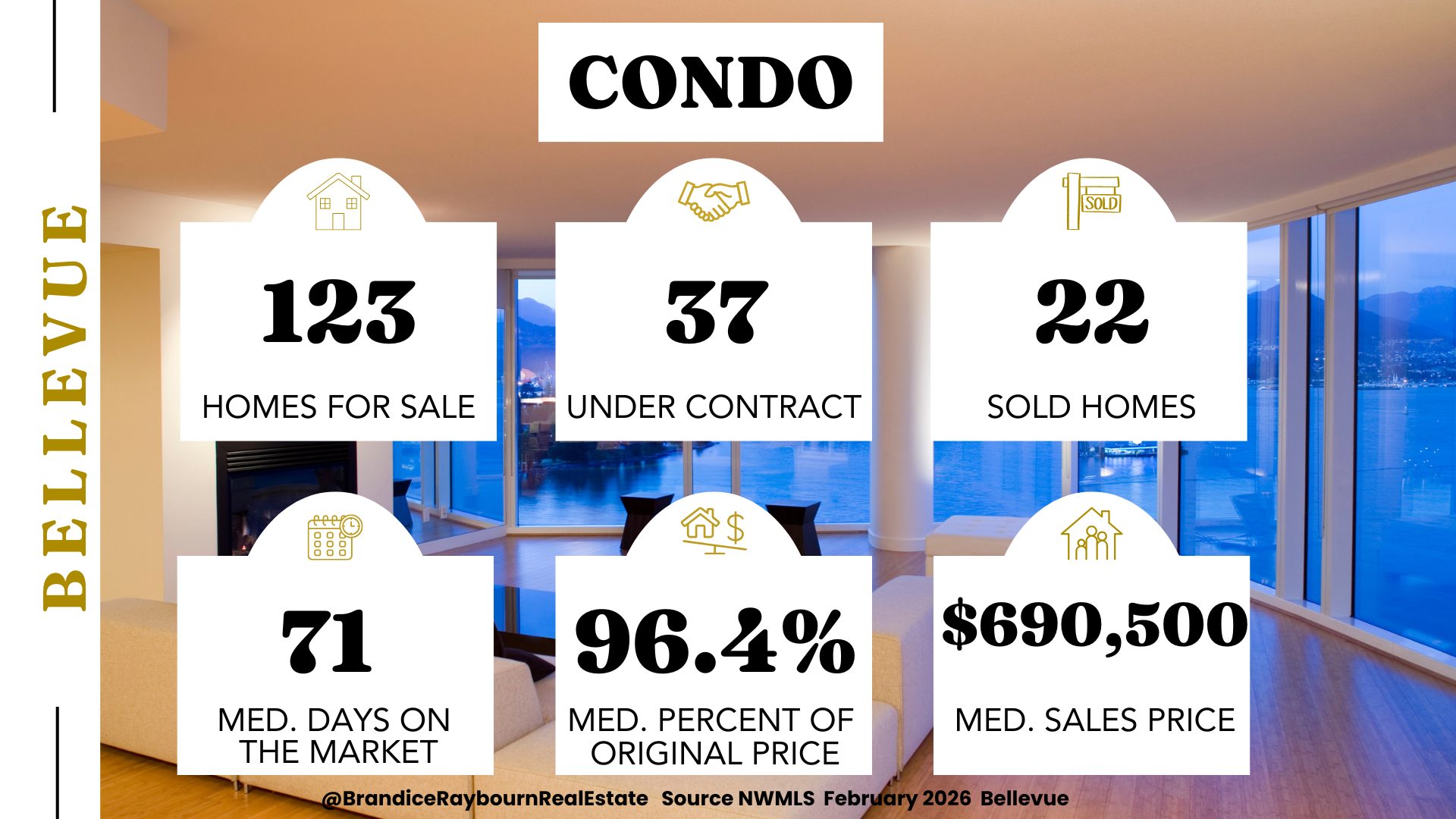

Condos: the slowest category right now

Condos are one of the clearest examples of the shift happening this month. With high inventory and median days on market pushing past 70 days, buyers are firmly in control of the timeline.

Buyers are comparing buildings, HOA structures, parking, and long-term costs closely. Condos that feel priced ahead of their value are being ignored. Sellers who do not adjust are sitting.

This is a noticeable softening from last month and one of the biggest changes in the data.

Source: NWMLS | Analysis by Brandice Raybourn

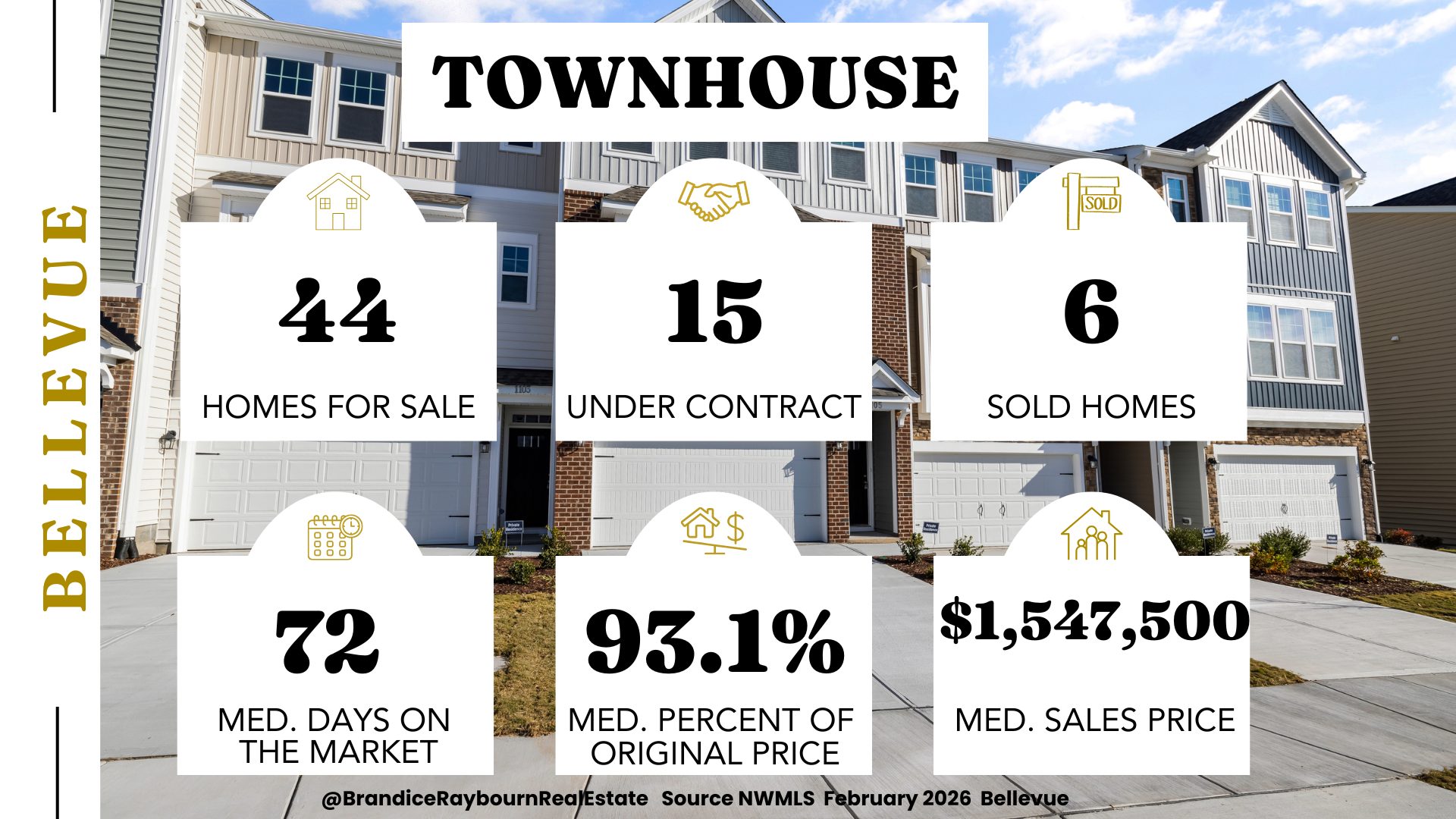

Townhomes: similar story, slightly less forgiving

Townhomes are also taking longer to sell, with days on market now similar to condos. Buyers are cautious and selective, especially in developments with multiple similar units available.

Turnkey townhomes still sell. Anything that requires compromise feels the drag immediately. Sellers in this category are competing directly with each other now, not buyers.

Source: NWMLS | Analysis by Brandice Raybourn Real Estate Broker

Residential resale by price point: where the contrast shows up

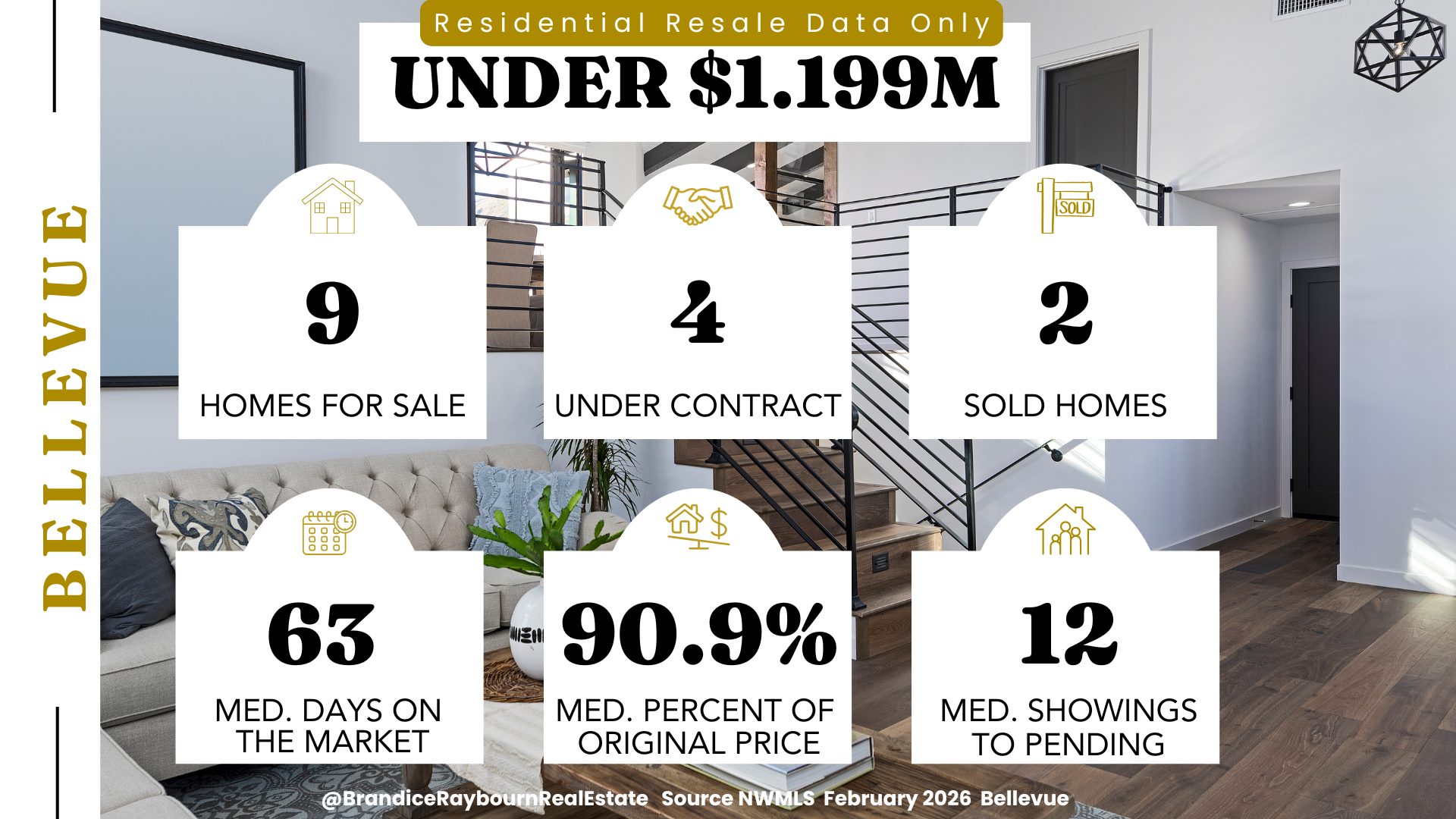

Under $1.199M

Inventory remains extremely limited, but buyer behavior has shifted. Days on market are longer, price retention dropped, and showing activity is lighter than last month.

This range is no longer driven purely by scarcity. Buyers want value. Homes that feel dated or overpriced are being passed over, even with limited options.

There are still no detached single-family homes actively for sale in this range, but buyers are no longer stretching just to get into Bellevue.

Source: NWMLS | Analysis by Brandice Raybourn Real Estate Broker

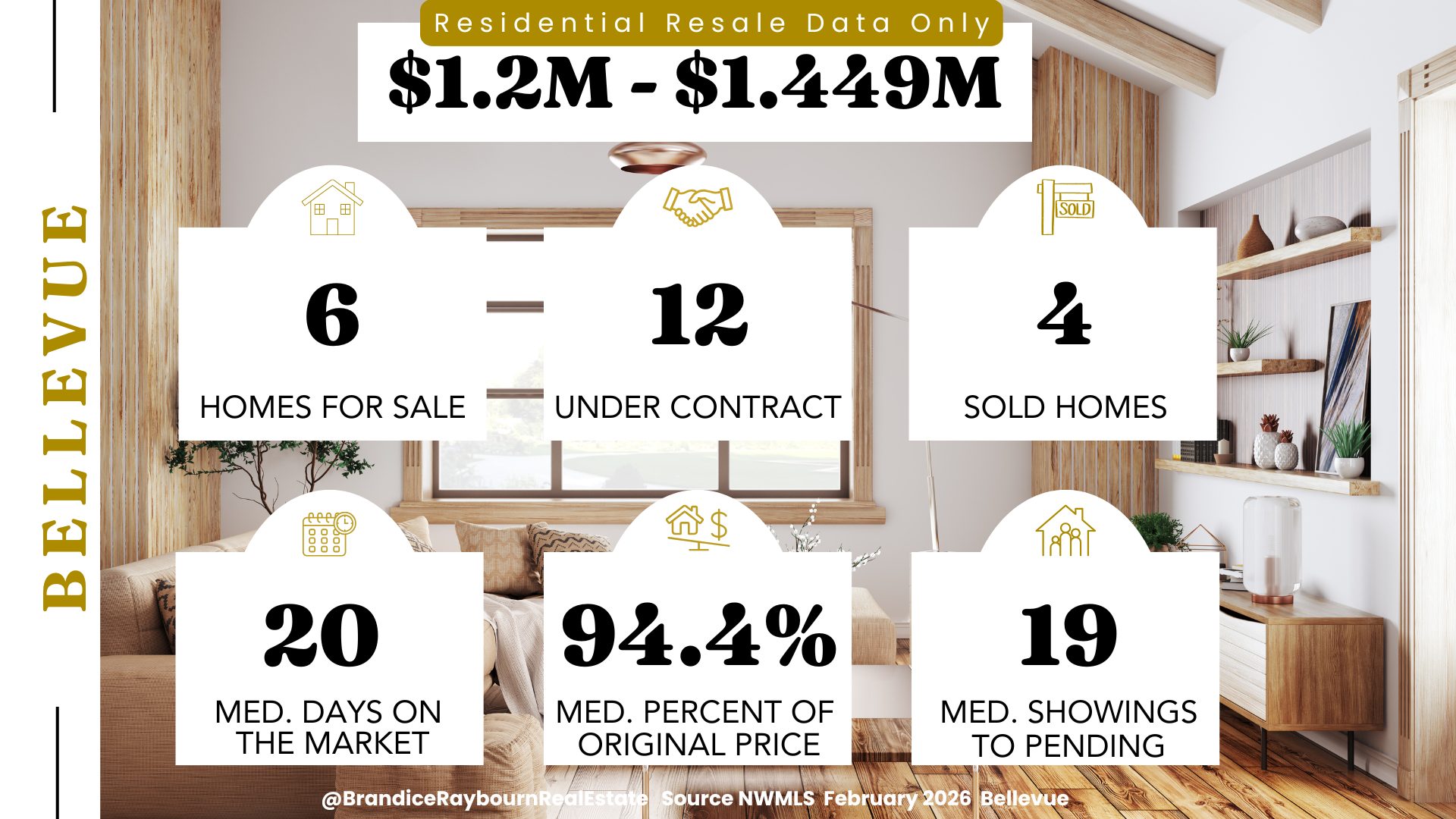

$1.2M–$1.449M

This range remains active, but buyers are more deliberate. Homes are still moving in a reasonable timeframe, yet pricing discipline matters more than it did a month ago.

This is still a key entry point for buyers looking to move up into a detached home, but it no longer feels automatic.

Source: NWMLS | Analysis by Brandice Raybourn Real Estate Broker

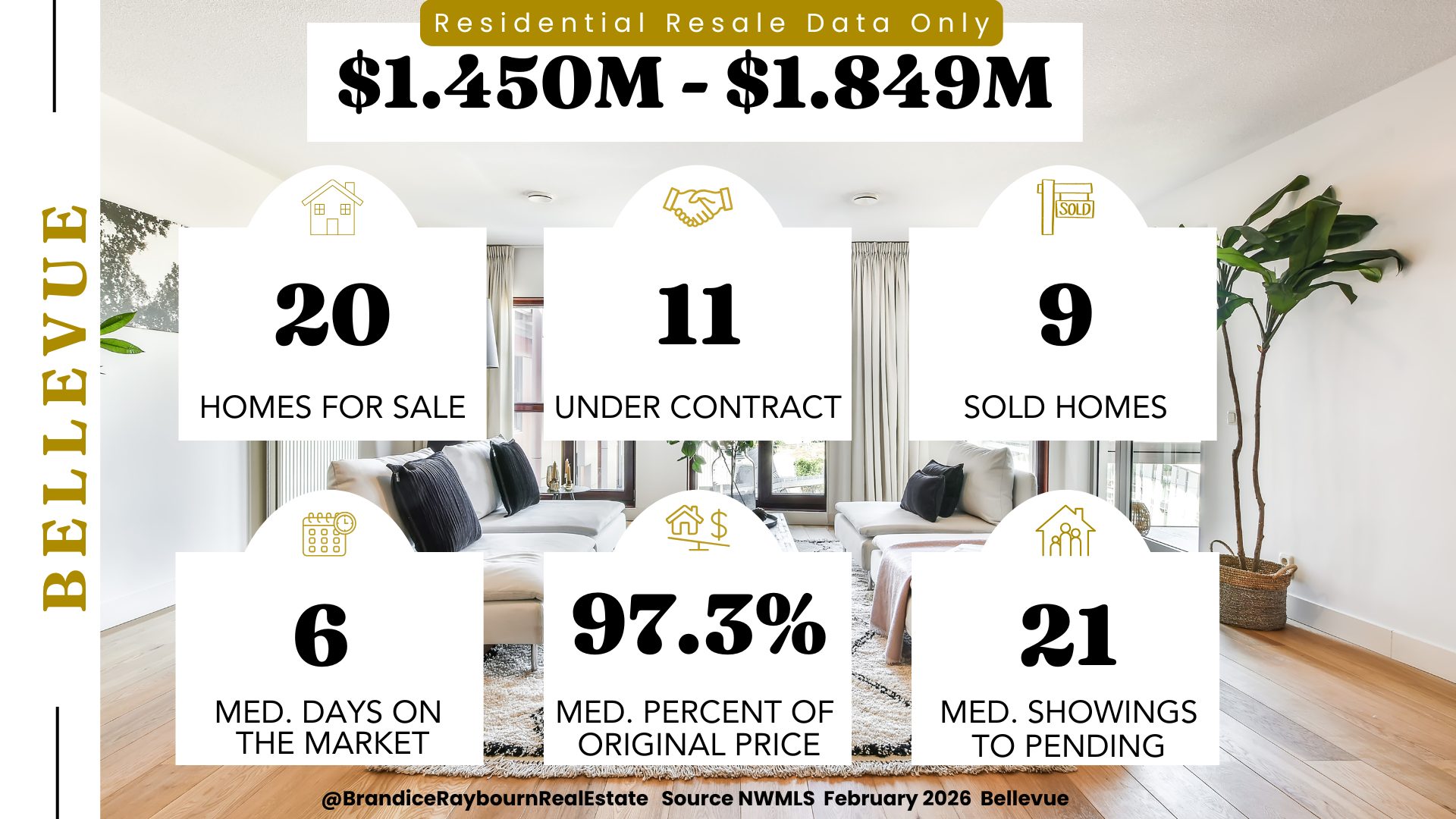

$1.450M–$1.849M

This is still one of the stronger ranges in Bellevue right now, but it is more selective than the headline numbers suggest.

Homes that are well priced, well located, and move-in ready are selling quickly and holding strong price retention. That is what’s driving the low median days on market. At the same time, there is meaningful inventory in this range that has been sitting for months, including a few homes that have been on the market for over a year.

The takeaway here is not that everything is moving fast. It is that buyers are acting decisively on quality and ignoring the rest. Pricing and presentation matter more than the average suggests, and sellers who miss the mark are being left behind.

Source: NWMLS | Analysis by Brandice Raybourn Real Estate Broker

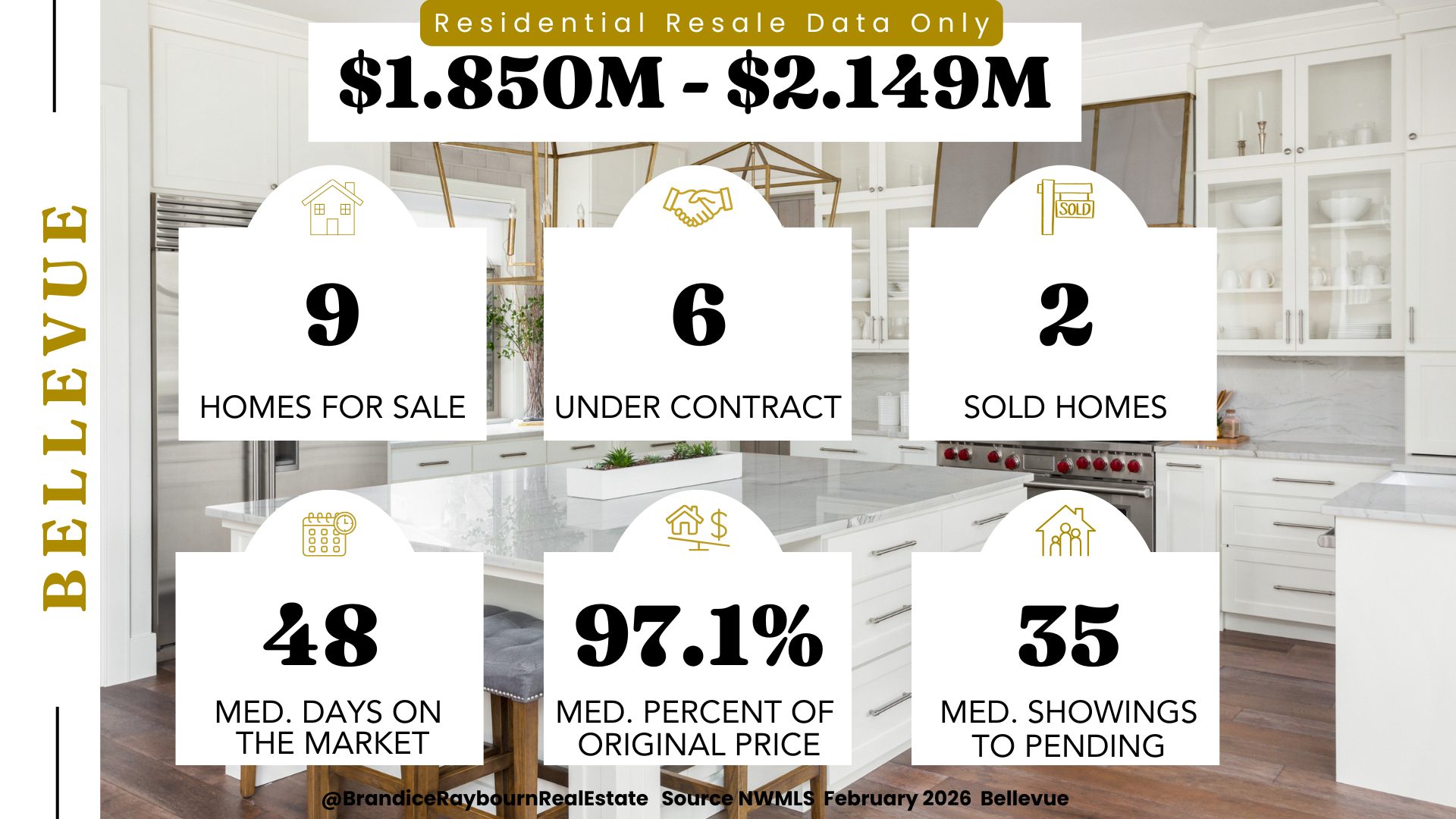

$1.850M–$2.049M

Inventory is limited, but buyers are thoughtful. Days on market are longer than the strongest mid-range, and showing counts suggest buyers are selective.

Homes that are priced right still sell. Homes that assume demand are sitting.

Source: NWMLS | Analysis by Brandice Raybourn Real Estate Broker

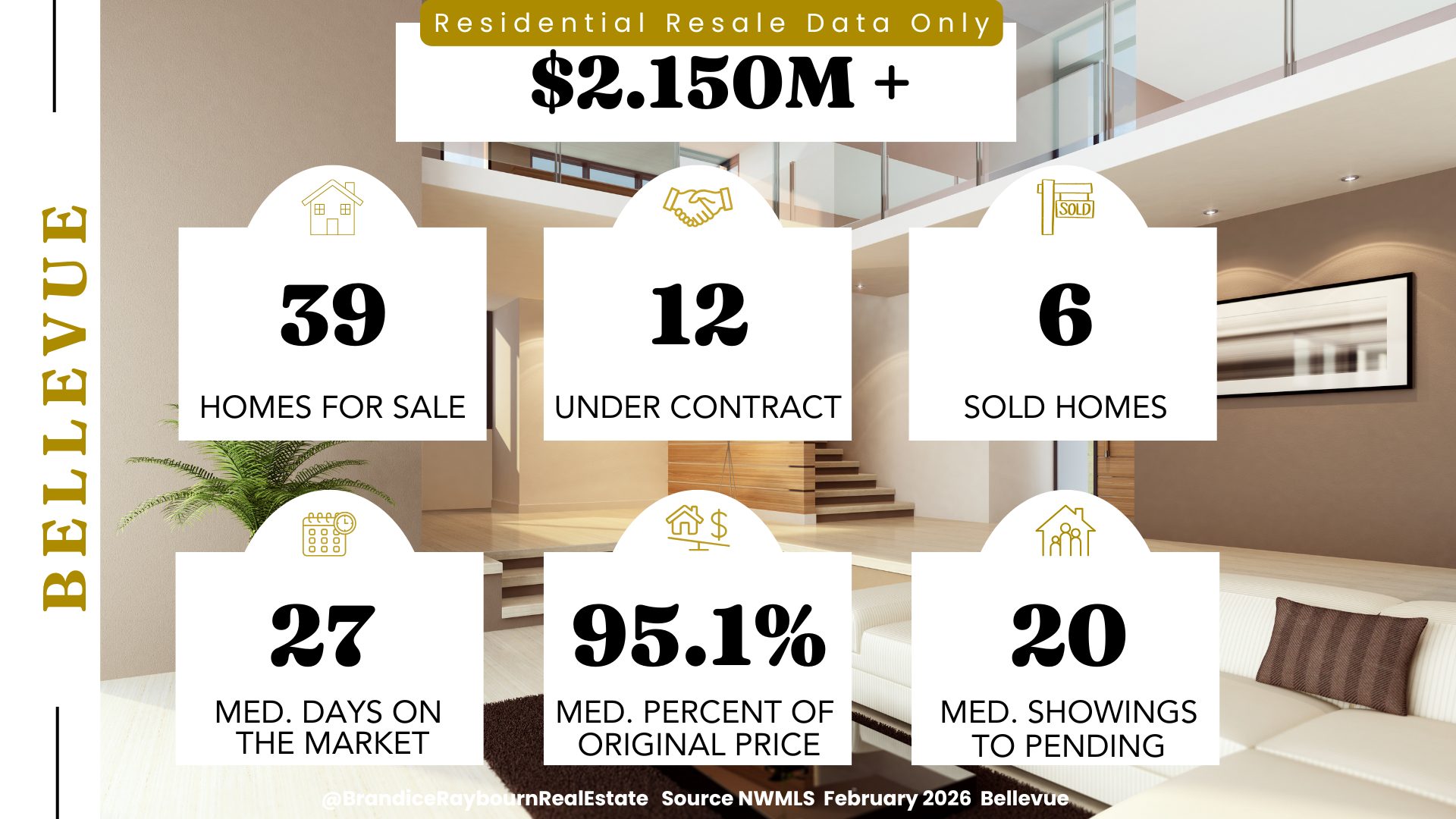

$2.050M+

Luxury inventory continues to stack. This range now holds the highest number of active listings, longer timelines, and more negotiation.

Buyers have leverage here. Sellers are competing against each other, not racing buyers. Accurate pricing and strong positioning matter more than ever in this range.

Source: NWMLS | Analysis by Brandice Raybourn Real Estate Broker

What the market feels like right now

This market is calmer, slower, and more deliberate than it was just last month.

Buyers are active but selective. Sellers can still succeed, but only with strategy. The gap between well-priced homes and everything else is widening.

This is not a market you can time.

You need to understand it.

Why price-point analysis matters

Citywide averages hide what actually changed this month. When you break Bellevue down by housing type and price point, the shifts become obvious.

I use this same data-driven approach to help buyers and sellers understand where leverage exists right now and how to adjust expectations, pricing, and timing accordingly.

If you want to talk through how these changes affect your specific price range, I’m happy to help.

Brandice Raybourn

Coldwell Banker Danforth

Everett Real Estate Broker

brandice@snohomesbybrandice.com

425-367-3881

Curious about other nearby markets? Market Reports

Relocating to Bellevue? Check out my community page here:

Moving to Bellevue, WA? Real Estate Insights with Brandice Raybourn

Data sourced from NWMLS and updated monthly.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link